Simplify Finance with AI That Understands You

Empower your financial institution with intelligent automation and AI-driven insights to simplify complex processes, ensure regulatory compliance, and deliver personalized, seamless experiences across channels.

Sample BFSI Workflows Automated through AIRA

Banking Operations

- Account opening and KYC processing

- Transaction reconciliation and reporting

- Loan application processing and approval

- Credit card application processing

- Payment processing & settlements

- Account maintenance & updates

- Statement generation and distribution

- Fraud detection alert processing

Insurance Operations

- Policy quotation and issuance

- Premium calculation and collection

- Claims processing and verification

- Policy renewal processing

- Insurance document verification

- Underwriting data collection

- Agent commission calculations

- Regulatory compliance reporting

Investment Banking

- Trade settlement processing

- Portfolio performance reporting

- Client onboarding and KYC

- Risk assessment reporting

- Market data analysis and reporting

- NAV calculations

- Financial statement analysis

Regulatory Compliance

- AML (Anti-Money Laundering) checks

- Regulatory report generation

- Audit documentation preparation

- Risk monitoring and reporting

- Compliance verification checks

- Suspicious activity reporting

- License and certification tracking

- Policy enforcement monitoring

Customer Service

- Customer query processing

- Service request management

- Address and contact updates

- Document verification and processing

- Customer communication management

- Customer feedback analysis

- Service level monitoring

Transforming BFSI with Intelligence

At AIRA, we transform how Banking, Financial Services, and Insurance (BFSI) organizations operate. Using advanced AI, machine learning, and data analytics, we help institutions streamline processes, reduce risks, enhance customer experiences, and fuel long-term growth. Explore our tailored solutions designed specifically for BFSI challenges.

Some Typical Benefits:

10-20%

10-20%

10-40%

10-40%

20-40%

20-40%

10-25%

10-25%

Featured AI Use Cases for BSFI

Credit Scoring & Risk Assessment

Leverage AI to evaluate the creditworthiness of individuals and businesses by analyzing financial history, behavioral patterns, and market trends to predict the likelihood of default accurately.

Fraud Detection & Prevention

Utilize real-time data analytics and machine learning to detect suspicious transactions, uncover hidden fraud patterns, and implement proactive risk mitigation while ensuring full regulatory compliance.

Cashflow and Liquidity Management

Anticipate future cash flow availability and liquidity requirements using predictive models, helping financial institutions maintain healthy reserves and make informed investment or lending decisions.

Loan Default Prediction

Apply predictive algorithms to assess borrower behavior and financial signals to forecast loan default risk, improving loan eligibility decisions and dynamic interest rate setting.

Insurance Claim Prediction & Fraud Detection

Identify patterns in claim history and customer profiles to forecast legitimate vs. fraudulent insurance claims, reducing losses and accelerating genuine claims processing.

Predictive Maintenance for ATMs and IT Infrastructure

Use IoT data and predictive analytics to forecast failures in ATMs and critical IT systems, enabling proactive maintenance and minimizing service disruptions.

Customer Churn Prediction

Analyze customer engagement, transaction data, and sentiment to detect churn signals early, empowering banks to deploy timely retention campaigns and personalized offers.

Portfolio Optimization & Investment Predictions

Employ AI models to simulate various market scenarios and predict asset performance, supporting data-driven portfolio adjustments and smarter investment decisions.

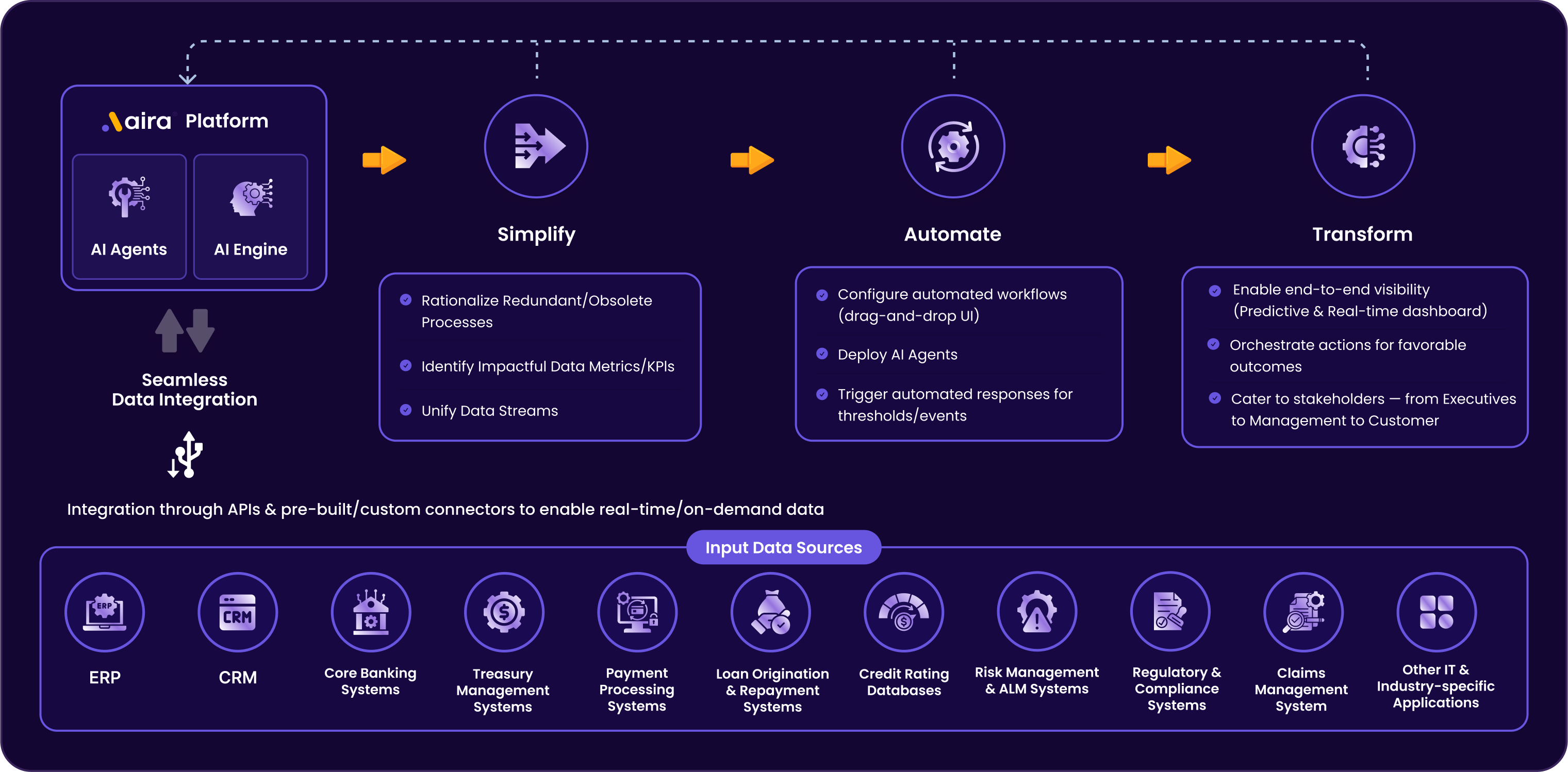

Solution Approach

Why Choose AIRA for BSFI?

At AIRA, we blend deep industry expertise with a sharp understanding of the BFSI sector’s unique challenges. Leveraging advanced AI, machine learning, and data analytics, we deliver actionable insights that drive innovation, streamline operations, and minimize risk. Our solutions consistently help financial institutions achieve measurable gains in cost efficiency, risk control, and customer satisfaction.

Contact Us today to learn how we can help transform your operations.